The Ultimate Guide to AAT vs ACCA: Which Accounting Qualification Is Right for You?

If you’re planning a career in accounting, you’ve probably come across two big names:

👉 AAT (Association of Accounting Technicians)

👉 ACCA (Association of Chartered Certified Accountants)

Both are respected and globally recognised. But here’s the challenge: they serve different purposes, suit different career stages, and require different investments of time, money, and effort. So how do you know which one is right for you?

In this ultimate guide, we’ll give you everything you need to make a confident decision. Whether you’re just starting out, switching careers, or thinking about progressing to senior roles, this guide will walk you through:

✅ What AAT and ACCA are

✅ The key differences between them

✅ Who each qualification is best for

✅ Common pathways (and whether you need both)

✅ How McArthur Online can help you get started

Let’s break it down step by step.

What Is AAT?

The Association of Accounting Technicians (AAT) is the UK’s leading entry-level accounting qualification. It’s designed for:

-

Beginners

-

Career changers

-

People without a finance degree

-

Small business owners looking to manage their own accounts

AAT offers a practical, hands-on route into finance, covering everything from basic bookkeeping to advanced accounting tasks. You study up to three levels:

-

Level 2 (Foundation) → Basic bookkeeping, double-entry, Excel skills

-

Level 3 (Advanced Diploma) → VAT, final accounts, ethics, management accounting

-

Level 4 (Professional Diploma) → Financial statements, budgeting, tax, audit, leadership

Many students complete Level 2 and 3 within 12–18 months and go straight into jobs like:

✅ Accounts Assistant

✅ Bookkeeper

✅ Payroll Clerk

✅ Finance Administrator

It’s also a popular stepping stone to further qualifications like ACCA, especially as you get exemptions from some early ACCA papers after AAT.

What Is ACCA?

The Association of Chartered Certified Accountants (ACCA) is a globally recognised chartered accountancy qualification.

It’s designed for:

-

People with an accounting foundation (AAT, degree, or similar)

-

Learners ready to commit to several years of advanced study

-

Those aiming for senior positions like financial controller, management accountant, auditor, or CFO

To qualify, you need to complete:

✅ 13 exams (fewer if you have exemptions from AAT or other qualifications)

✅ An ethics module

✅ Three years of relevant work experience

Most ACCA students take around 3–4 years to complete the full qualification alongside work.

Side-by-Side Comparison: AAT vs ACCA

| Feature | AAT | ACCA |

|---|---|---|

| Entry Requirements | None | Prior qualifications or exemptions needed |

| Study Time | 6–24 months (Levels 2–4) | 3–4 years (including work experience) |

| Focus | Practical, technician-level accounting | Strategic, management, audit-level work |

| Career Outcome | Accounts assistant, bookkeeper, payroll | Chartered Certified Accountant, senior roles |

| Cost | Lower total cost, flexible by level | Higher total cost, longer-term commitment |

| Typical Starting Point | Beginners, career changers | Post-AAT or degree, advanced learners |

Do You Need AAT Before ACCA?

Technically, no — but for many people, it’s the smarter path. Why?..

✅ AAT gives you real-world, practical skills you can use in jobs right away

✅ You get exemptions from early ACCA exams, saving time and money

✅ It builds your confidence, especially if you’re returning to study after a break or changing careers

Many employers prefer candidates who’ve taken the AAT → ACCA route because they’ve combined hands-on knowledge with longer-term ambition.

If you already have a degree in accounting or a related field, you may be able to go straight to ACCA. But if you’re a beginner or career changer, AAT is often the best place to start.

Who Should Choose AAT?

👉 You’re starting from scratch in accounting

👉 You want to break into finance quickly and practically

👉 You’re a small business owner managing your own finances

👉 You want a respected qualification without committing to years of study

👉 You want the flexibility to progress later (e.g., moving on to ACCA)

Who Should Choose ACCA?

👉 You already have accounting knowledge (AAT, degree, or other qualifications)

👉 You want to work globally or in senior roles

👉 You’re aiming for Chartered Certified Accountant status

👉 You’re ready for a long-term study and experience commitment

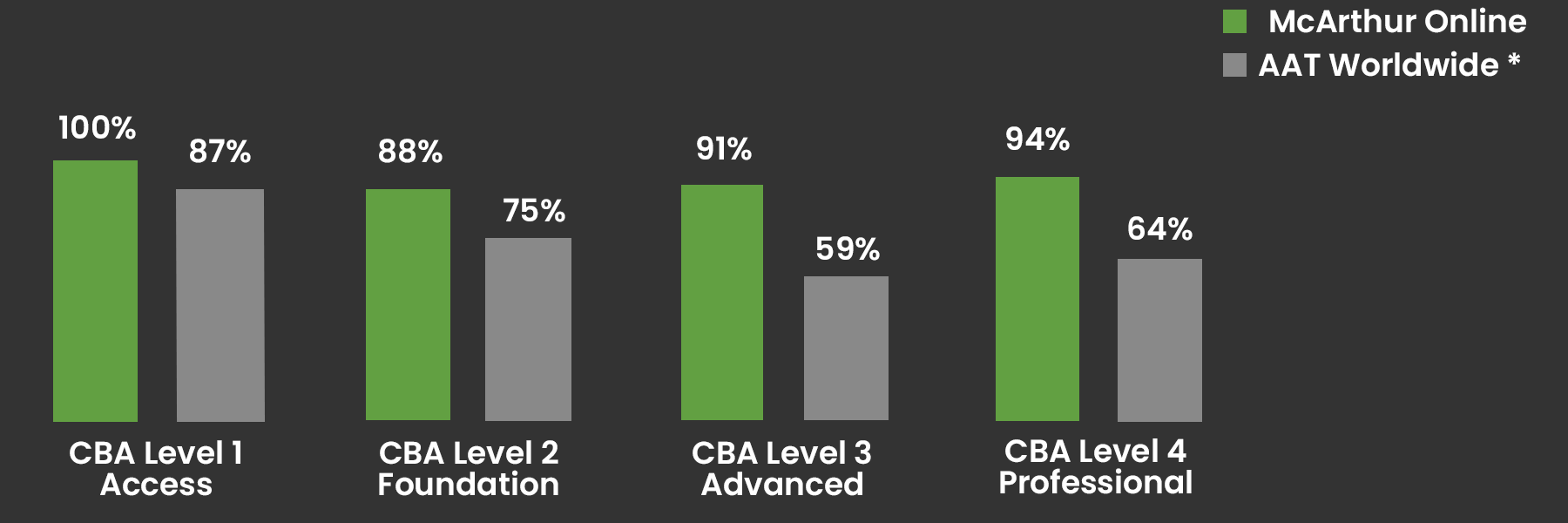

Why Choose McArthur Online?

When you study with McArthur Online, you’re not just signing up for a course — you’re joining a community of learners on the same path.

✔ Specialists in AAT training

✔ 100% online courses designed for career changers

✔ Flexible learning – evenings, weekends, or self-paced

✔ Tutor support to guide you at every stage

✔ Proven success stories from students who’ve changed careers

Final Thoughts: Which Qualification Should You Choose?

If you’re a beginner or changing careers, start with AAT. It’s the practical, respected, job-ready foundation you need — and you can always progress to ACCA later.

If you’re already experienced or hold a degree, ACCA may be your next step. Either way, your accounting career starts with making a confident, informed choice.

👉 Ready to start? Explore our AAT Level 2, 3, and Bookkeeping courses today.